At the heart of most insurance behaviours are decisions about risk and probability. Behavioural science can explain the behaviours that underpin these seemingly irrational choices.

The classic insurance industry is built in a way which pits the insured against the insurer, fighting over the same coin. This culminates in a vicious cycle of distrust, making premiums go up, and turning claims processes into an ordeal.

As the consumer evolves and established companies become vulnerable to startup challengers, the insurance industry must evolve to disrupt and reinvent the insurance business model.

We all act in ways that seem irrational. Consumers don't always switch to a better option or cheaper product."

Cowry uses behavioural science to help you improve the claims process at every stage, for both the customer and supplier.

By embedding the human touch within your organisation, we can help you to design a user experience which minimises conflicts of interest, and strategically place reminders of morality, leading to more valuable, longer-lasting relationships with your customers.

The global insurer Chubb wanted to understand the science behind why customers were getting frustrated with their online claims portal.

By conducing a Behavioural Audit, our expert behavioural science team identified the principles that were driving cognitive friction throughout the process.

Outcome: To the Chubb team’s surprise, Cowry identified over 70 friction points in the customer journey and portal.

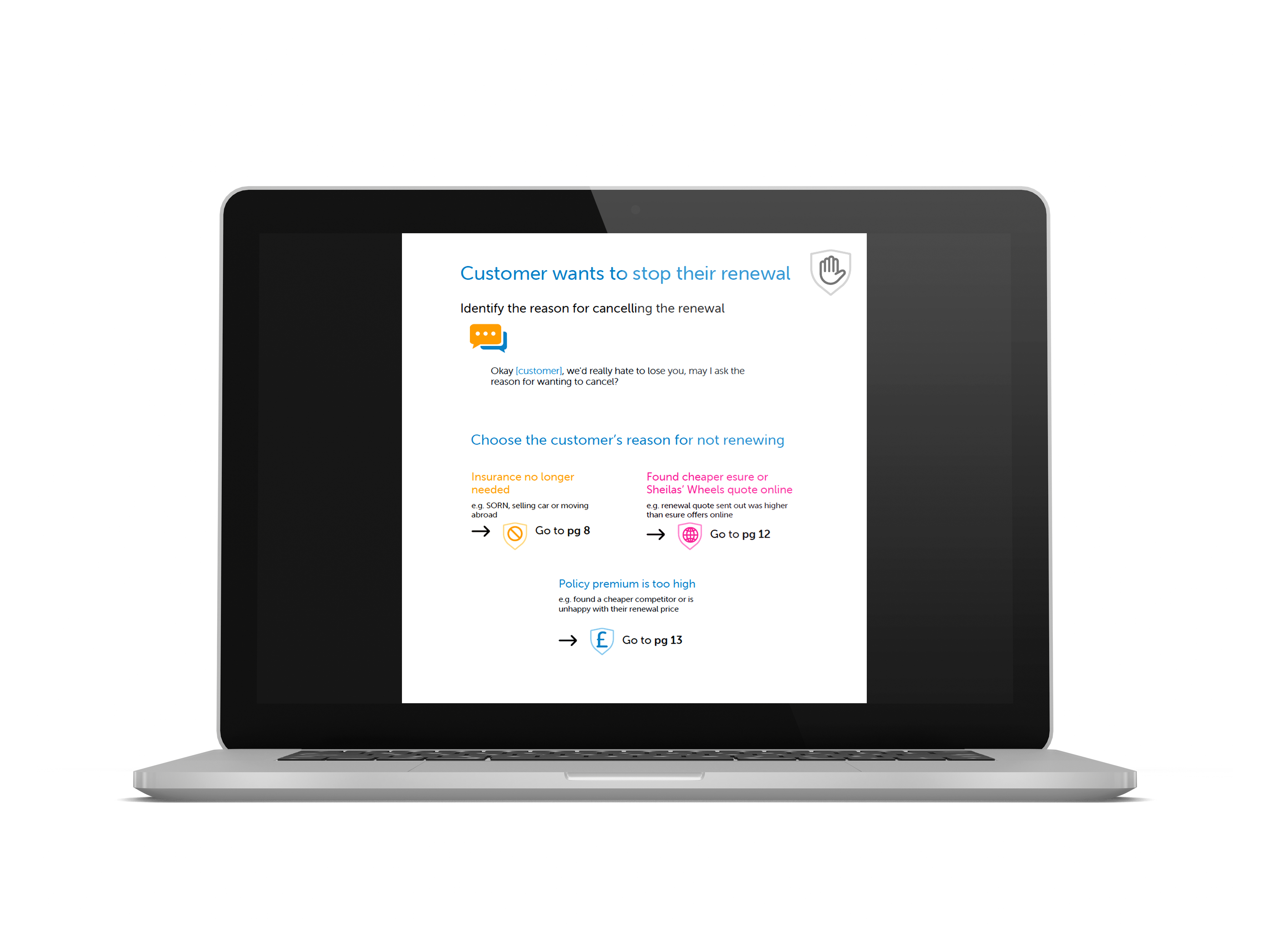

Following regulatory changes to the renewals process, Saga’s retention levels had decreased within their contact centres.

Cowry helped transform the conversations the agents were having with customers using compliant and ethical conversational redesigns to retain more policies when customers called the centre.

Outcome – ROI of £8.73 : £1 for the Control vs Treatment groups.

Legal and General are on a journey to embed and sustain behavioural science within the organisation.

Multiple groups of CX, UX and executional sprint teams have completed Cowry’s Core and Expert Training Programmes.

Now, a number of behavioural science experts within Legal & General are being mentored by the Cowry team in the Practitioner Programme.

Outcome – upskilling of the Legal & General team to facilitate the creation of an internal behavioural science centre of excellence.

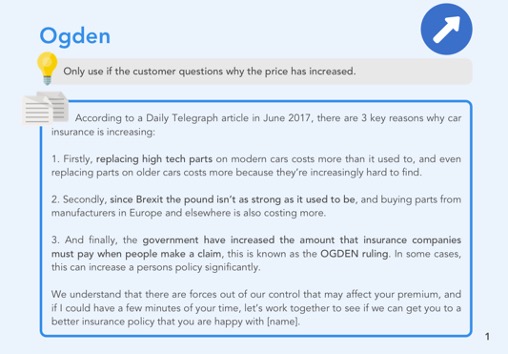

During the pandemic, Esure wanted to deliver a new exceptional customer experience within their call centres.

Cowry fundamentally redesigned the conversational structure and created a Digital Playbook – an interactive pdf.

The results were significant, better designed playbooks made for a better experience for both colleagues and customers alike.

Outcome – significant increases in customer retention using the new Digital Playbook.

Download this exclusive edition which features an in-depth look at the new AI driven Behavioural Fingerprint from Cowry Consulting which identifies the most common C Factors that hinder and help positive customer experiences in the Finance Sector.

And don’t miss the interview with Christian Hunt, the host of the popular Human Risk Podcast, the hottest financial sector academic papers for behavioural science and lots more!

Want the latest insights in applying Behavioural Science to Financial Services? Sign-up to our finance newsletter today so you don't miss out.

Our quarterly newsletter curates the most informative content for you to read, watch & listen, you'll also gain exclusive access to the release of our Financial Case Studies & in-house opinion pieces written by our team of Behavioural Science Experts.

"The Trial cohort are still outperforming the Control cohort on Retention, Average Call Duration and Membership".

— Anthony Gallaway, Senior Operations Manager, Saga

Want to learn more about applying behavioural science in insurance?

Give us a call or leave us your details to start up a conversation:

Download your free copy of On The Brain 📖