In the UK, half a million individuals experience harm due to gambling, and a further two million are considered at risk of harm. Further, this harm has significant spill-over effects as on average, problem gamblers negatively impact six other individuals.

Gambling-related harm is an escalating issue. 2020 saw a 9% increase in calls to the National Gambling Helpline, and a 14% increase in treatment sessions. The recent introduction of the Financial Conduct Authority's Consumer Duty regulations has placed a heightened responsibility on financial institutions to identify and support customers at-risk to gambling harm. In this context, Cowry collaborated with HSBC in the pursuit of protecting vulnerable customers from such harm.

Transform customer experiences

Cowry identified three major barriers preventing customers from engaging with support from HSBC.

Firstly, emotional factors such as feelings of shame, often deter individuals from seeking help, in turn fostering avoidance behaviours.

Secondly, motivational barriers arise when individuals perceive gambling support, advice and tools as exclusively applicable to those with severe gambling problems, thereby reducing their motivation to engage with available resources.

Finally, awareness constitutes a significant obstacle, as less than 50% of people are aware that support tools such as gambling transaction blocks exist. These barriers served as a foundation on which Cowry addressed the behavioural challenge of increasing awareness and uptake of gambling support.

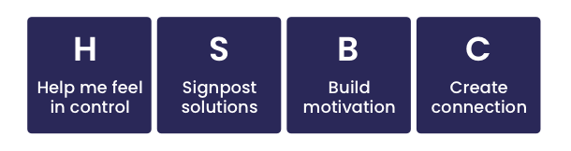

Cowry rooted its approach in its previous work on vulnerable customers, using their H.S.B.C. framework as a foundation. The framework breaks down the psychological factors of individuals facing difficult circumstances, and categorises these considerations into easily digestible support actions:

These principles informed the gambling support interventions, which consisted of several re-designed touchpoints. The most significant were HSBC UK’s gambling support public webpage, and behaviourally-targeted in-app and desktop online banking support messages.

The redesigned in-app messages were tailored to HSBC’s existing customer risk segmentation, and aimed to orient customers towards the gambling support webpage. For instance, a medium-risk customer would see on their banking app: “Many customers wish they controlled their gambling behaviour sooner” (employing social norms to motivate), whilst a high-risk customer would see: “Take control of your gambling today. Acting now will protect your future” (appealing to present bias to emphasise the severity of the issue and the importance of acting now).

Following a pilot study, these nudges were found to be effective. Compared to in-app message prompts for other HSBC UK campaigns, Cowry’s prompts are generating more click-throughs from high-risk customers, ultimately increasing awareness of the gambling block feature.

The second intervention involved redesigning the gambling hub website.

Three key nudges were adopted to drive engagement with gambling support:![]() Presenting questions such as: “Have you noticed any of these behaviours lately?”, thereby encouraging reflection and proactive self-realisation.

Presenting questions such as: “Have you noticed any of these behaviours lately?”, thereby encouraging reflection and proactive self-realisation.

![]() Providing binary next steps: "I want to freeze my uncontrolled spending” or “I want to take a different route" defaults the customer into action, making use of at least one means of support.

Providing binary next steps: "I want to freeze my uncontrolled spending” or “I want to take a different route" defaults the customer into action, making use of at least one means of support.![]() Finally, the language of the gambling transaction block was changed from “block” to “freeze,” in order to strike a more empowering tone, appealing to the customer’s ego bias.

Finally, the language of the gambling transaction block was changed from “block” to “freeze,” in order to strike a more empowering tone, appealing to the customer’s ego bias.

The pilot results project an increase of 6000 customer visits and interactions with the Gambling Support Webpage, in addition to a projected increase of 1500 customers engaging and turning on the gambling block for the first time ever.

The results from the pilot study suggest that the interventions satisfied the key performance indicators of increasing both engagement and awareness of HSBC’s gambling support. This has warranted an expansion of the study to run over a longer timeframe, involving a further 25,000 high-risk customers.

19 March

Read about how Cowry helped Phoenix to develop an active approach to supporting vulnerable customers.

13 March

Read about how Cowry helped Southern Water's contact centre teams in driving compelling conversations and positive customer interactions.

We’d love to chat to you about how to start applying behavioural science - book a slot below to catch up with Jez and find out more.

Download your free copy of On The Brain 📖