Aegon wanted to dig deeper and identify the key reasons why customers didn’t engage with their pensions. Read on to discover the insights that our innovative psychometric techniques such as Cognitive Interviews revealed.

Uncover subconscious insights

People find it hard to engage with their future finances, especially their pensions. We wanted to get under the skin of the problem and find the barriers that got in the way of financial planning and decision making.

All too often customers tell researchers want they want to hear, what makes them sound intelligent and what they want other people to think of them.

So we didn’t ask them what they thought, we just went direct and asked their brains!

To dig deeper into the costumer's subconscious we used Cognitive Interviews as a psychometric technique. A trained qualitative researcher using probing, recall, think aloud and vignettes questioning techniques allows them to listen to what customers don't say or how they say it - as much as what they actually say.

These techniques are often used in questioning by the police, detectives and other types of investigative roles. The interviews last for 45 mins and are video-taped and the transcripts and films viewed together.

The Cognitive Interviews identified three key insights into pension decision making

Mental Accounting : customers have three types of money pots : Fun Money, Safe Money and Serious Money. Emotionally, pensions sit in serious money with critical illness and insurance products.

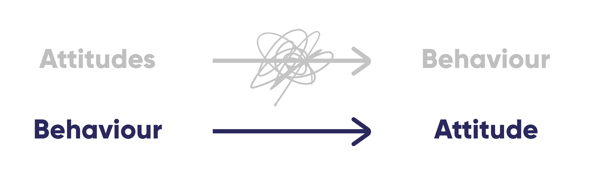

Behaviour drives Attitude : customers understood similar products like ISAs because they ‘did’ ISAs.

Do to Think: therefore to get people we need customers to 'do' pensions to understand pensions and not the other way around.

We believe in partnering with the experts and Cowry has a proven methodology using cognitive and behavioural psychology that really works. Through our pilots we have already seen significant benefits across a number of areas of the business in terms of how we’re supporting customers and making it easier for them to engage and make good decisions about their financial futures."

Michael Reed-Smith, Retail Director, Standard Life

Read further Dig case studies below or explore more case studies featuring Fix, Teach and Build.

19 December

See how Cowry applied behavioural science to transform Aegon’s Contact Centre conversations.

18 December

Learn how Aegon embedded behavioural science with the help of the Cowry Academy.

We’d love to chat to you about how to start applying behavioural science - book a slot below to catch up with Jez and find out more.

Download your free copy of On The Brain 📖