Saving is hard. Whether it be saving for retirement, a holiday or a deposit on a house, storing your pennies away is always challenging. The hardest part about it is that the exact thing we are saving for is often far off in the future. With our brains hard wired to want instant gratification, we need all the help we can get to help us do more for our future, today. So how can we bridge this emotive gap? Psychologists in America have been experimenting, and they believe that they have found a great tip to help us optimise our saving behaviour. Participants in the control group arrived and were just given a standard educational financial presentation, focusing on the importance of savings and a few simple saving strategies. The experimental group on the other hand, had a presentation focusing on emotion-based exercises evoking positive responses around a nostalgic item, relevant to their saving focus.

Whilst both groups significantly increased their rates of saving, the treatment group increased their savings by 67% compared to the control groups 22% increase over three weeks.

This triple increase represents a monumental $10,020 more saved on average if maintained over the year, almost double that of what they were saving prior to the study ($5,838). It also had psychological benefits too, with the experimental group feeling more ready to save, whilst also reporting more confidence in their ability to save and improvements to their financial health.

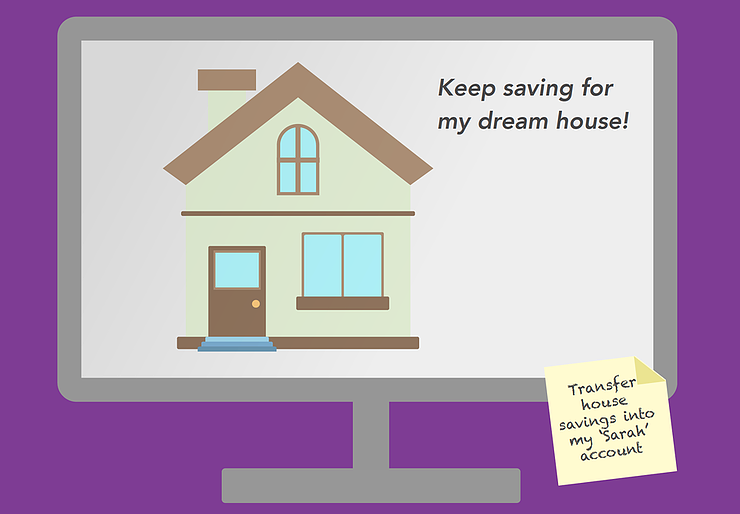

So, what can we do? Well firstly find a nostalgic object, and think of how you got it and feel all of the emotions and values are associated with it, and it is likely these also underlie you current savings goal. Secondly create some visual motivators for saving. Want a new car? Tape a picture of it to your laptop. Saving for a house? Have it as your phone screensaver.

A top tip from the study was to personalise your bank accounts, naming them something personal to you - using the name of your child, pet or surname is a great way of doing so. And the final step is to take action when you are motivated. Set up weekly or monthly automatic contributions into the account. It only takes a moment, then once you have forgotten about it for a few months, you’ve saved!

If you struggling to save, looking to start, or just want to maintain what you are doing, the best thing to do is get personal with it.

References:

Han, S., Lerner, J.S., & Keltner, D. (2007). Feelings and consumer decision making: The appraisal-tendency framework. Journal of Consumer Psychology, 17(3), 158-168. Horner, A.J., Bisby, J.A., Bush, D., Lin, W-J., and Burgess, N. (2015). Evidence for holistic episodic recollection via hippocampal pattern completion. Nature Communications, 6(7462), 1-11.

Klontz, B.T., & Britt, S.L. (2012). Financial trauma: Why the abandonment of buy-and-hold in favour of tactical asset management may be a symptom of post-traumatic stress. Journal of Financial Therapy, 3(2), 14-27.

Klontz, B., & Klontz, T. (2009). Mind over money: Overcoming the money disorders that threaten our financial health. New York, NY: Broadway Books